How AI Drives Enhanced Financial Management in Apps

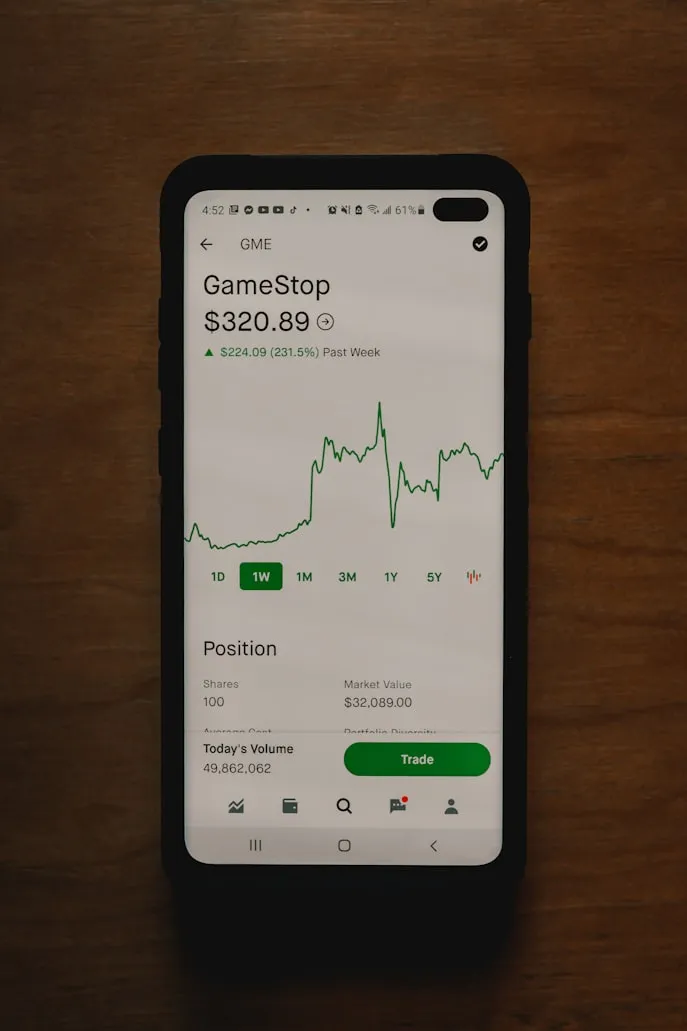

The Impact of AI on Financial Management Apps

The integration of artificial intelligence (AI) into financial management applications has revolutionized how users approach budgeting and expense tracking. With AI, apps have evolved from simple ledger books to sophisticated tools that provide personalized insights and automation that were unimaginable just a few years ago.

Personalizing Financial Planning with AI

One of the standout features of AI in budgeting applications is its ability to personalize financial planning. Through machine learning algorithms, these apps can analyze a user’s spending habits and offer tailored advice. This personalization is critical in helping users make informed decisions about their finances.

Example: PocketGuard's Custom Budgeting Suggestions

PocketGuard is a great example of how AI can tailor budget suggestions based on individual spending patterns. The app tracks expenses, identifies recurring payments, and categorizes spending to help users understand where their money is going. Based on this data, PocketGuard offers insights into possible savings by suggesting spending limits across different categories, effectively acting as a personal financial advisor.

The pros of using an AI-driven app like PocketGuard include:

- Customized Insights: Users receive tailored advice that reflects their actual spending habits.

- Time-Saving: Automated tracking means less time spent manually categorizing expenses.

However, there are also cons to consider:

- Privacy Concerns: Users must be comfortable sharing their financial data with the app for it to work effectively.

- Potential Overreliance: Users may become too dependent on the app, reducing their personal financial literacy over time.

Automating Expense Tracking

Automation is another area where AI has made significant strides in financial management apps. By automatically categorizing and tracking expenses, these apps reduce the time users spend managing their budgets, allowing them to focus on achieving financial goals.

Case Study: Emma's Smart Categorization

Emma is a financial management app that leverages AI to provide smart categorization of transactions. It connects to users' bank accounts and credit cards, tracking expenses in real-time. Emma's AI algorithms learn from past behaviors to improve the accuracy of its categorization over time.

The benefits of Emma's automated expense tracking include:

- Reduced Manual Entry: Users don't need to input transactions manually, minimizing human error.

- Comprehensive Financial Overview: Real-time insights into spending patterns help users quickly adjust their budgets if necessary.

Potential drawbacks might include:

- Security Risks: Connecting bank accounts to the app raises concerns about data security and potential breaches.

- Initial Setup Time: Linking multiple accounts can be time-consuming initially, though it's a one-time process.

Choosing the Right AI-Enhanced App for You

Selecting the right AI-powered budgeting application depends largely on individual needs and preferences. Here are some considerations when choosing a financial management app:

- User Interface: A clean, intuitive interface can greatly enhance user experience.

- Data Privacy: Consider the app's privacy policy and how your data will be stored and used.

- Cost: Many apps offer free versions with limited features, while premium versions unlock advanced functionalities.

Practical Tips for Maximizing App Usage

To get the most out of your AI-driven budgeting application, follow these tips:

- Regularly Review App Insights: Spend time each week reviewing your spending patterns and adjusting your budget accordingly.

- Set Realistic Financial Goals: Use the app’s goal-setting features to create achievable targets for savings or debt reduction.

- Stay Informed: Keep up with updates and new features that might enhance your experience further.

The Future of AI in Financial Management

The future of AI in budgeting apps looks promising with developments focusing on deeper integration and more intelligent insights. As AI technology advances, we can expect more refined personal finance tools that cater even more closely to individual user needs.

This evolution will likely lead to even greater reliance on AI for personal financial management, making it crucial for developers to continue emphasizing user privacy and data security.

Conclusion

AI has fundamentally altered the landscape of financial management applications by offering personalized financial planning and automating expense tracking. While these advancements bring numerous benefits, they also necessitate careful consideration of privacy and data security concerns. By understanding both the advantages and challenges of AI-driven financial tools, users can make informed decisions to improve their budgeting strategies effectively.