Exploring Leading Financial Apps: Which One Fits Your Budgeting Style?

Understanding Your Budgeting Needs

Before diving into the vast array of financial applications available today, it's crucial to identify your budgeting style and needs. Are you a detail-oriented planner who meticulously tracks every penny, or do you prefer a more relaxed approach, setting broad spending goals without the need for extensive breakdowns? Understanding this will guide your choice of app.

Many budgeting apps cater to different styles, from those that offer comprehensive tracking with intricate categories to others that provide a more minimalist interface focusing on essential expenses and savings. The key is finding one that aligns with your personal finance habits and goals.

Essential Features of Leading Financial Apps

While each financial app offers a unique combination of features, there are several core functionalities you should consider:

- Usability: A user-friendly interface is vital. The best apps are intuitive and easy to navigate, even for those who aren't tech-savvy.

- Integration: Seamless integration with bank accounts and other financial services can simplify tracking expenses and income, reducing manual input.

- Analytics: Comprehensive analytics provide insights into spending patterns, helping you identify areas for improvement.

- Customization: The ability to customize categories and set personalized alerts or goals increases the app's utility.

Top Contenders in the Financial App Market

Here we examine some of the most popular financial apps available today, detailing their standout features and ideal user profiles.

Mint

Overview: Mint is a stalwart in the world of budgeting apps, known for its robust feature set and ease of use. It integrates with most major banks, offering real-time updates on your spending.

Key Features:

- Comprehensive Tracking: Automatically categorizes transactions, making it easy to track spending across various categories.

- Bill Payment Alerts: Notifies users of upcoming bills and due dates, helping avoid late fees.

- Free Credit Score: Provides access to your credit score for better financial health monitoring.

Who It's For: Ideal for users looking for a detailed overview of their finances with minimal manual input.

You Need a Budget (YNAB)

Overview: YNAB follows a zero-based budgeting philosophy, which encourages users to allocate every dollar they earn to maximize financial efficiency.

Key Features:

- Goal Setting: Helps users prioritize savings goals alongside regular expenses.

- Proactive Budgeting: Encourages users to plan ahead for future expenses rather than simply react to them.

- Education Resources: Offers an array of tutorials and workshops to enhance budgeting skills.

Who It's For: Best suited for disciplined individuals who wish to adhere strictly to their budget and value proactive financial planning.

PocketGuard

Overview: PocketGuard is designed for simplicity, providing users with a clear picture of how much money they have left to spend after accounting for bills, goals, and necessities.

Key Features:

- Simplicity: Offers a straightforward interface showing how much money is left after essentials are covered.

- Customizable Categories: Allows users to set personalized spending categories.

- In-app Savings Suggestions: Provides tips on how to save money based on spending habits.

Who It's For: Perfect for those who want a quick, easy-to-understand snapshot of their finances without diving into detailed analytics.

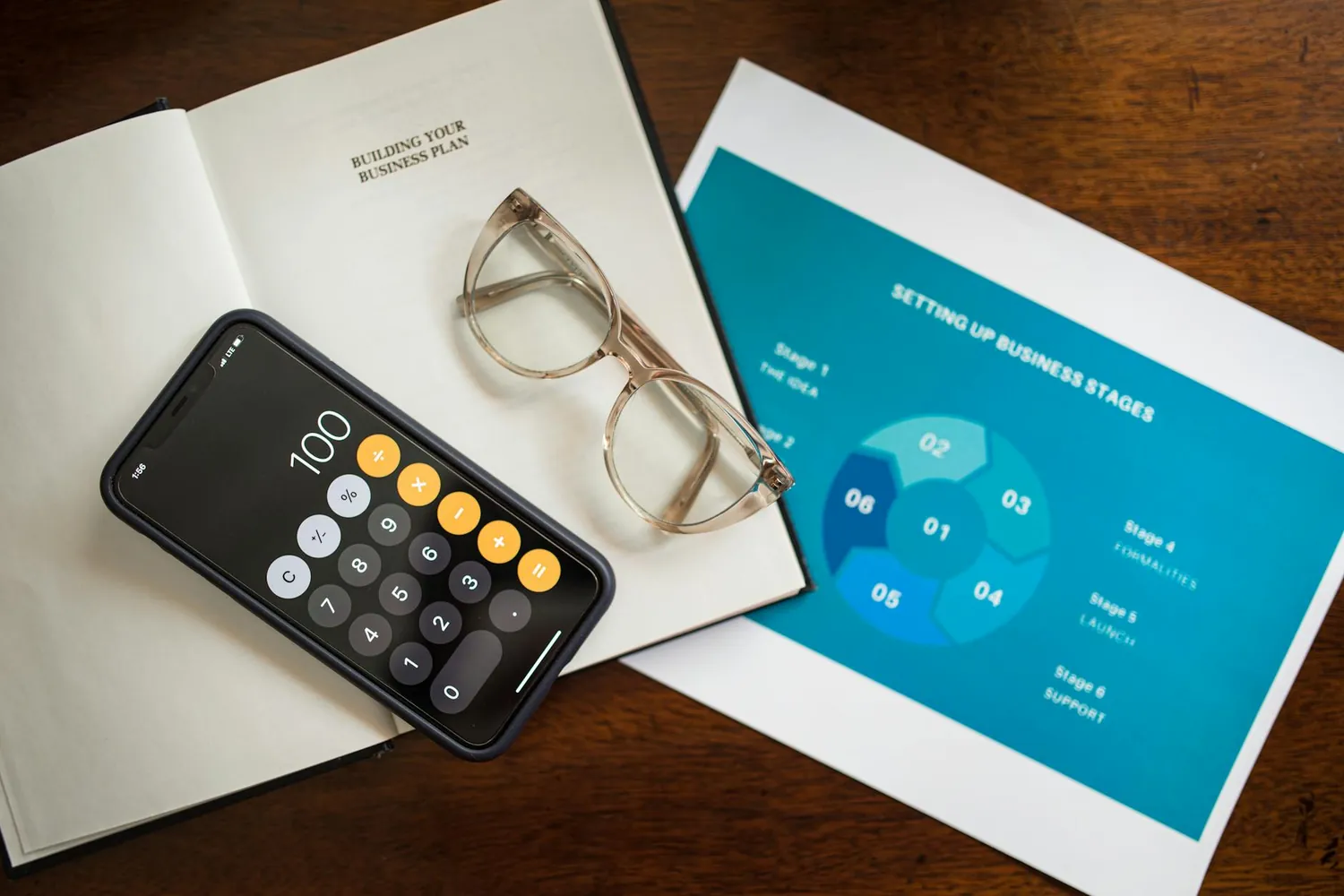

A Mini-Framework for Assessing App Suitability

To determine which app best fits your needs, consider the following framework:

- Define Your Goals: Identify your primary financial goals. Are you aiming to save for a specific purpose, reduce debt, or simply monitor spending?

- Evaluate Features Against Needs: Match your goals with the features offered by each app. Look for those that provide tools directly supporting your objectives.

- Consider Usability and Accessibility: Ensure the app's design and functionality align with your tech comfort level. If an app feels overwhelming or unintuitive, it might deter regular use.

The Trade-offs: Free vs. Paid Apps

While many budgeting apps offer free versions with limited functionality, some require subscriptions for access to premium features. It's essential to weigh the benefits of advanced features against the cost. For instance, YNAB charges a monthly fee but provides in-depth budgeting tools that may justify the expense for serious budgeters.

If your needs are simple, free options like Mint or PocketGuard might suffice. However, if you require extensive customization or analytical capabilities, investing in a paid app could enhance your budgeting success.

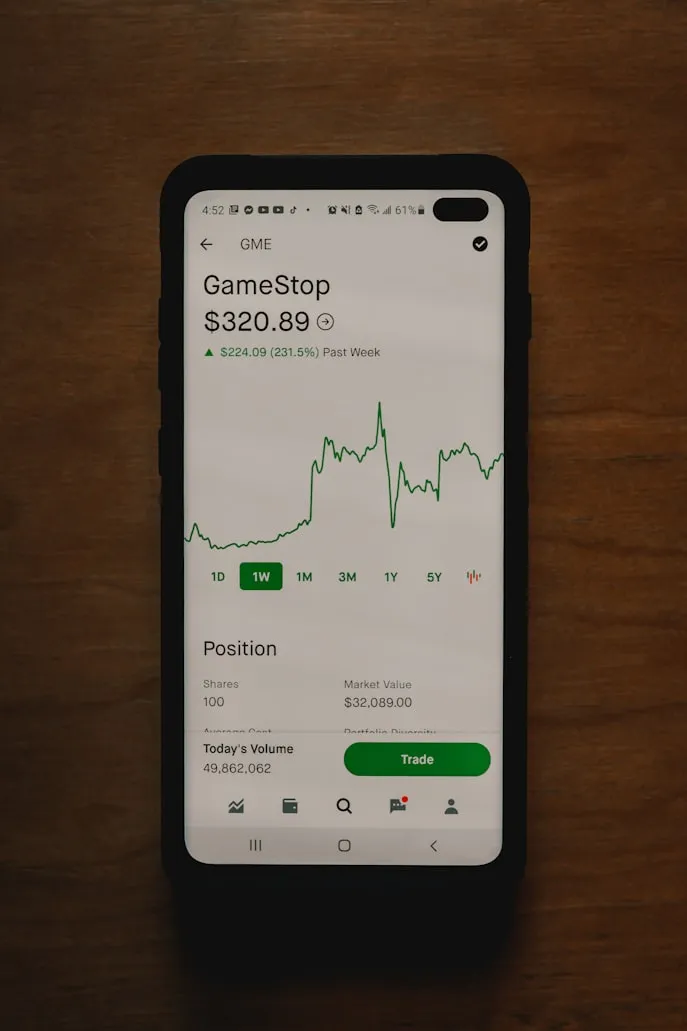

Merging Technology with Personal Finance

The advent of sophisticated financial apps has revolutionized personal finance management. By leveraging technology, users can automate mundane tasks like transaction recording and benefit from insights through data analytics, which can lead to more informed decision-making and better financial outcomes.

The right app not only simplifies day-to-day management but also empowers users to take control of their financial future. Whether you're just starting on your financial journey or seeking to optimize an existing strategy, these tools can offer invaluable support tailored to various needs and preferences.