Exploring AI-Driven Budgeting Tools for Enhanced Financial Management

Understanding AI in Personal Finance

The intersection of artificial intelligence (AI) and personal finance is rapidly transforming how individuals manage their money. AI-driven budgeting tools are designed to automate and optimize financial tasks, offering personalized insights that were once the domain of financial advisors. These applications harness machine learning to analyze spending habits, predict future expenses, and suggest actionable strategies to maximize savings.

Key Features of AI-Driven Budgeting Tools

Modern budgeting applications powered by AI typically offer several innovative features:

- Automated Expense Tracking: AI algorithms categorize expenses automatically, saving users time and effort.

- Personalized Budget Recommendations: By analyzing spending patterns, these tools suggest tailored budgets to help users meet financial goals.

- Predictive Analytics: AI predicts future spending trends based on historical data, enabling better financial planning.

- Savings Optimization: Applications can identify areas where users can cut costs or adjust expenditures to increase savings.

Popular AI-Driven Budgeting Applications

Several applications stand out for their advanced use of AI in budgeting:

1. Mint

Mint remains a popular choice due to its comprehensive approach to personal finance management. The AI capabilities in Mint allow it to provide personalized financial insights and budgeting suggestions. Users can link multiple bank accounts and credit cards to get a consolidated view of their financial health.

Key Workflow:

- Link bank accounts and credit cards for real-time updates.

- AI-driven categorizations for easy expense tracking.

- Receive personalized alerts for unusual spending patterns.

2. YNAB (You Need A Budget)

YNAB is renowned for its proactive budgeting approach, which focuses on giving every dollar a job. The application uses AI to provide insights into your spending habits, helping you prioritize saving and debt repayment.

Key Workflow:

- Assign every dollar a specific purpose, such as bills, savings, or debt repayment.

- Use predictive analytics to adjust budgets in response to unexpected expenses.

3. Cleo

Cleo uses a chatbot interface to engage users in managing their finances. This interactive approach leverages AI for conversational interactions, allowing users to ask questions and receive instant financial advice.

Key Workflow:

- Interact with Cleo via messaging for budgeting advice and insights.

- Set savings goals and track progress through conversational prompts.

The Benefits of AI-Driven Financial Management

The integration of AI into financial management offers several advantages:

- Time Efficiency: Automation of repetitive tasks like categorizing transactions reduces the time spent on manual entry.

- Enhanced Accuracy: Machine learning algorithms minimize human errors in tracking expenses and setting budgets.

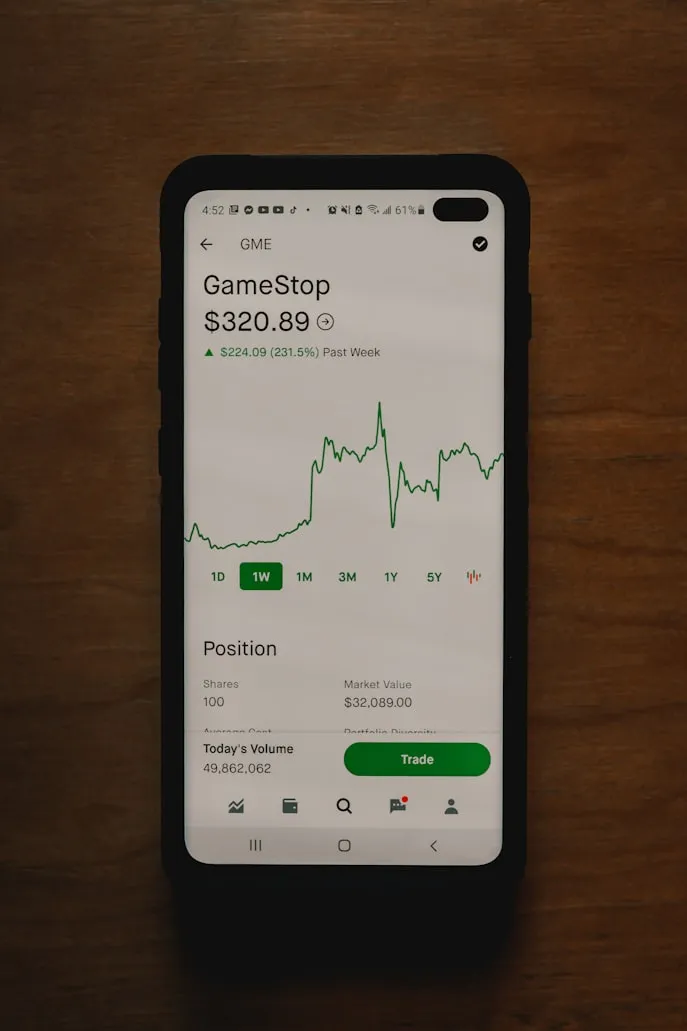

- Improved Decision-Making: With personalized insights, users can make informed decisions about saving, spending, and investing.

Potential Challenges and Considerations

While AI-driven tools offer numerous benefits, users should be aware of potential challenges:

- Privacy Concerns: Storing sensitive financial data with third-party applications raises privacy and security issues. It's crucial to choose applications with robust encryption and data protection policies.

- User Trust: Some users may be skeptical about relying solely on AI for financial advice. It's important to use these tools as aids rather than replacements for professional advice.

Practical Tips for Using AI-Driven Budgeting Tools Effectively

To maximize the benefits of these applications, consider the following tips:

- Start with Clear Goals: Define what you aim to achieve—whether it's saving a certain amount, paying off debt, or tracking expenses more accurately.

- Regularly Review Financial Data: While automation is convenient, periodic reviews ensure you're aware of any discrepancies or areas needing attention.

- Stay Informed About Updates: Developers frequently update apps with new features; staying informed can help you leverage the latest functionalities.

The Future of AI in Personal Finance

The future of personal finance management looks promising with ongoing advancements in AI technology. We can expect more sophisticated features such as real-time analysis, enhanced security measures, and deeper integration with financial institutions that provide even richer data for smarter budgeting decisions.