Assessing User Experience with Mint Compared to Personal Capital's Features

Evaluating Budgeting Features in Mint and Personal Capital

When it comes to personal finance management, two platforms frequently come to the forefront: Mint and Personal Capital. Both offer robust solutions for managing budgets and tracking investments, but their approaches differ significantly. Understanding these differences is crucial for users seeking the right fit for their financial needs.

Mint's Budgeting Approach

Mint, developed by Intuit, is renowned for its comprehensive budgeting tools. It's designed to give users a granular view of their finances, automatically categorizing transactions and offering budget creation based on past spending habits.

Upon connecting your accounts, Mint immediately provides insights into your financial landscape. Users can create detailed budgets across multiple categories, like groceries, entertainment, and utilities. The application sends alerts when you're approaching or exceeding your set budget limits, helping you stay on track.

- Pros: The automatic categorization and budget alerts are particularly useful for hands-off users who prefer minimal manual input.

- Cons: While Mint is excellent at tracking spending, it lacks robust investment tracking features, which can be a drawback for users focused on portfolio management.

Personal Capital's Budgeting Capabilities

Personal Capital, meanwhile, offers a more investment-oriented approach. While it does provide budgeting tools, they aren't as detailed or customizable as Mint's. Personal Capital emphasizes cash flow management over traditional budgeting, which is ideal for users who have variable income streams.

The cash flow tool aggregates income and expenses over time, giving users an overview of how much they're saving each month. This can be especially beneficial for freelancers or individuals with irregular income patterns.

- Pros: Better suited for those whose primary concern is wealth building rather than day-to-day budgeting.

- Cons: Less effective if you need fine-grained control over individual spending categories.

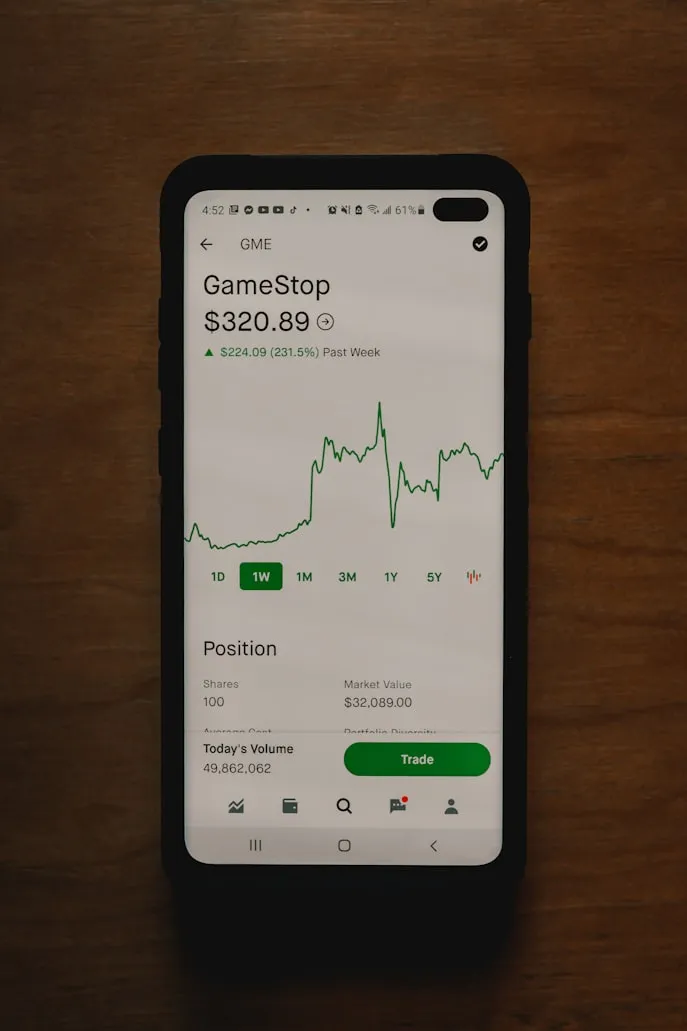

Investment Tracking: A Comparative Analysis

Mint's Investment Features

While Mint primarily focuses on budgeting, it does offer some basic investment tracking capabilities. Users can link their brokerage accounts to get a simplified view of their investment performance. However, it does not provide deep insights or advanced tools for portfolio analysis.

- Pros: Suitable for beginners who want a single platform to glance at both budgeting and investment without deep analysis.

- Cons: Limited features make it inadequate for serious investors who require detailed reports and analytics.

Investment Power with Personal Capital

Personal Capital shines in its investment tracking features. It offers comprehensive tools for analyzing your portfolio's performance, asset allocation, and fees. With the Investment Checkup tool, users receive detailed insights that help in optimizing their investments for better returns.

The Retirement Planner is another standout feature that allows users to simulate different retirement scenarios using their current financial data. This forward-looking feature helps users plan long-term financial strategies effectively.

- Pros: Excellent choice for investors seeking to maximize returns and prepare for retirement with detailed analysis and planning tools.

- Cons: May be overwhelming for those only interested in basic budgeting without the need for complex investment tools.

Choosing the Right Tool for Your Financial Needs

The choice between Mint and Personal Capital largely depends on your financial goals and the level of detail you require from your financial software.

If Budgeting is Your Main Focus

If keeping tabs on everyday expenses is your priority, Mint might be the better choice. Its user-friendly interface and automatic transaction categorization simplify the budgeting process, making it ideal for those who want straightforward budget oversight without delving into investment details.

If Investment Tracking is Key

On the other hand, if you’re keen on developing a deeper understanding of your investments and wish to actively manage your portfolio, Personal Capital should be at the top of your list. Its extensive suite of analytical tools provides comprehensive insights into your financial future, empowering you to make informed investment decisions.

Integrating Both Platforms: A Holistic Approach

For those who find value in both sets of features, using Mint for day-to-day budgeting alongside Personal Capital for investment management can provide a well-rounded financial picture. This dual approach leverages the strengths of each platform, ensuring that neither budgeting nor investment tracking takes a backseat.

This strategy requires a bit more effort, as you'll need to manage information across two platforms. However, the payoff is a more tailored financial management system that covers both immediate spending needs and long-term financial health.

The Final Verdict

Both Mint and Personal Capital have proven themselves as formidable tools in the realm of personal finance management. Your choice should reflect your personal financial goals—whether that means meticulous budgeting or strategic investment growth. By understanding what each platform excels at, you can make an informed decision that aligns with your unique financial journey.